Loan Services

Loan is a financial arrangement where a lender provides money to a borrower, who agrees to repay it over time with interest, often used for personal needs, business growth, or buying assets.

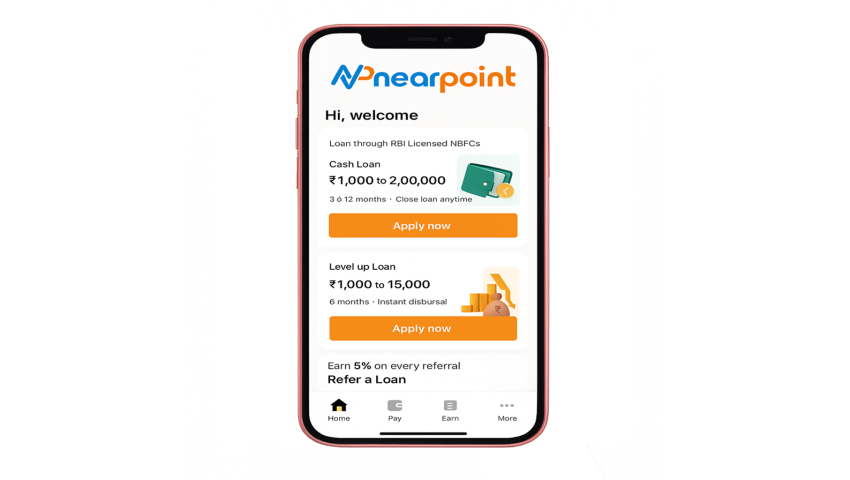

NearPoint Loan Services

Fast, Easy & Secure Digital Loan Solutions for Everyone

Overview

NearPoint Financial Services offers a range of digital loan facilities designed to meet the financial needs of individuals, salaried professionals, and small business owners.

Through the NearPoint App and Web Portal, customers can easily apply for various types of loans from top NBFCs, Banks, and Financial Institutions, with transparent processing and quick disbursal.

Our goal is to provide fast, flexible, and secure loan solutions that empower people to achieve their financial goals conveniently.

Loan Categories Available

| Loan Type | Purpose / Description |

|---|---|

| Personal Loan | For personal needs such as medical expenses, marriage, travel, etc. |

| Business Loan | For small businesses, startups, or business expansion. |

| Home Loan | For purchasing, constructing, or renovating a house/property. |

| Gold Loan | Loan facility against pledged gold ornaments. |

| Two-Wheeler Loan | For purchasing a new bike or scooter. |

| Education Loan | For higher education or academic financial needs. |

Loan facilities are available through leading NBFCs and banking partners.

Flexible tenures and competitive interest rates based on eligibility and profile.

Key Features

Quick Approval: Instant eligibility check and pre-approval process.

Minimal Documentation: Requires only Aadhaar, PAN, and basic financial documents.

Affordable Interest Rates: Rates depend on customer profile and lender offers.

Flexible EMI Options: Choose repayment tenures from 6 to 60 months.

100% Secure Process: Fully digital and data-encrypted loan applications.

24x7 Availability: Apply anytime via the NearPoint App or Portal.

Eligibility Criteria

| Requirement | Details |

|---|---|

| Age | 21 to 58 years (may vary as per loan type) |

| Income | Minimum ₹10,000/month (for salaried applicants) |

| Documents | Aadhaar Card, PAN Card, Salary Slip / Bank Statement |

| CIBIL Score | 650+ preferred (for higher-value loans) |

Self-employed individuals and small shop owners are also eligible for business loans.

Loan Application Process

| Step | Action |

|---|---|

| 1 | Open the NearPoint App and go to “Loan Services” |

| 2 | Choose the preferred loan type (Personal, Business, etc.) |

| 3 | Fill in your details — Name, Income, Loan Amount, etc. |

| 4 | Upload KYC documents (Aadhaar, PAN, Bank Statement) |

| 5 | Submit the application for review |

| 6 | Bank/NBFC verifies and approves the loan |

| 7 | Loan amount is disbursed directly to your bank account |

Application Status: Track your loan status in real time through the NearPoint App.

Benefits for NearPoint Retailers & Agents

NearPoint Partners can earn additional income by working as Loan Referral Agents (LAP).

Each approved loan referral provides an attractive commission to the agent.

Benefits include:

Earn commission on every successful loan disbursal

No investment or license cost

100% online application and tracking

Combine loan referral with other services like AEPS, Recharge, and DMT

Expand your digital financial service portfolio

Why Choose NearPoint Loan Services

Partnered with trusted banks and NBFCs

Fast, paperless loan application process

Transparent terms with no hidden charges

Affordable interest rates and flexible EMI options

Dedicated support and guidance for applicants and partners

Start Your Loan Journey with NearPoint

Whether you’re a customer seeking quick funds or a retailer looking to expand your business offerings, NearPoint Loan Services provides a safe, reliable, and rewarding opportunity.

Apply today via the NearPoint App — simplify borrowing and empower your financial growth.